Update: U.S Energy Sector - The Best Performer For July | Tuesday, 01 August 2023

- Lester Davids

- Aug 1, 2023

- 1 min read

On Monday 03 July I highlighted the Energy as the sector as a recovery opportunity.

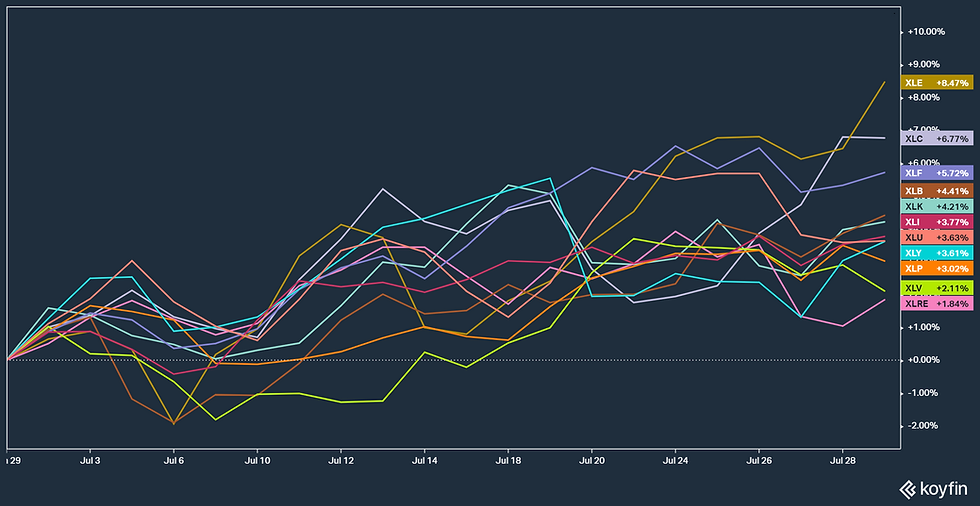

Out the 11 SPDR sector, the XLE has been the best performer for the month.

Sector Performance For July (via Koyfin)

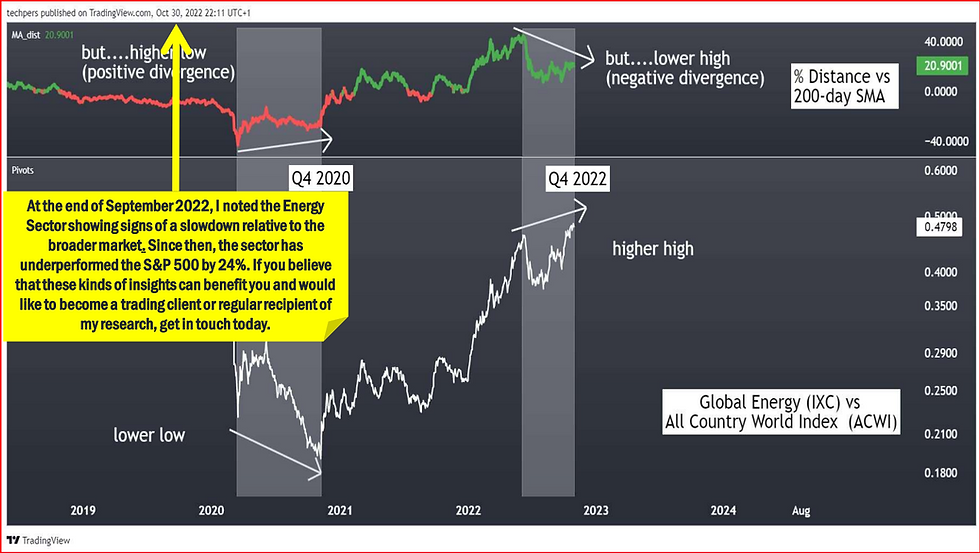

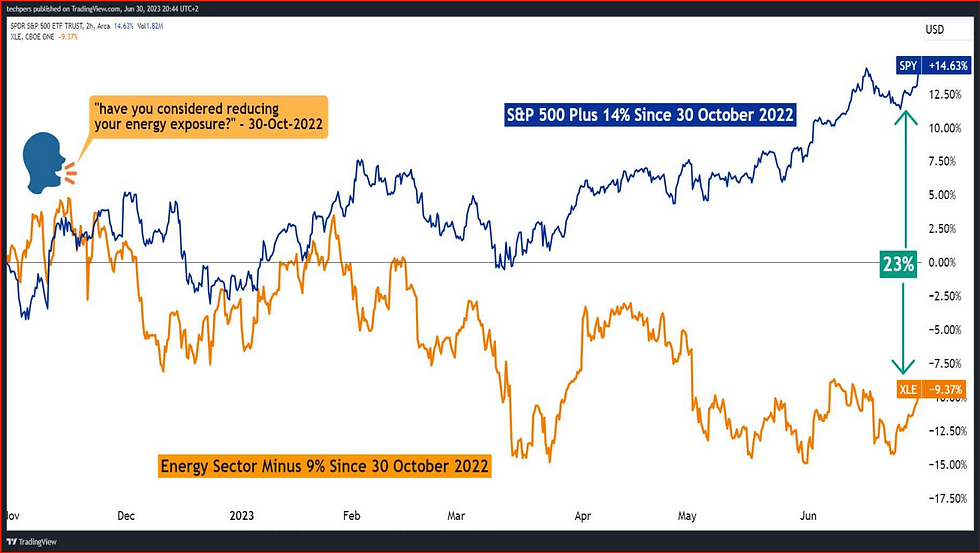

Initially, I discussed the potential underperformance in September 2022.

By the end of June 2023, Energy had underperformed the S&P 500 index by 23%

On 03 July, the following Energy ETFs were highlighted, with the trend lines and channels being a key factor. Also noted at the time was the oil price emerging from a consolidation phase.

Energy ETF Performance

If you are keen on becoming a frequent recipient of my research insights (including trade ideas), get in touch today.

Lester Davids

Analyst: Unum Capital

Comments