Notable is a page dedicated to fast-paced, running research commentary intended to alert to client to a potentially significant level or development, mainly from a technical perspective. Further, the content gives clients access to the analyst's perspective of an instrument which can help in preparing for a potential trading opportunity.

Please Scroll Down

For an enlarged view, click on the arrows in the top right corner of the image.

Thursday 05-October-2023, 06h30 Pepkor (PPH). Approaching Target. Bank/Take Profit. Original idea discussed here on this page.

Thursday 05-October-2023, 06h30 JSE Technical Summary: Short Term, as at yesterday's close.

This page is FULL. Continue reading here: https://www.unum.capital/post/___n2

Wednesday 04-October-2023, 08h21 STRATEGY COMMENT. Key Themes (1) Bond Yields Higher, Equities Lower (2) Volatility Spike (3) High Interest Rates & A Stronger US Dollar Capping An Advance In Risk Assets (4) Tactical Opportunities On Both The Long (Buy) and Short (Sell) Side.

MARKET BREADTH refers to how many stocks are participating in a given move in an index/exchange. Analyzing yesterday's end-of-day technical summary for the JSE, the WEAK category is where the majority of the 78 shares under coverage find themselves on a short term trending basis. The second most populated category is NEUTRAL while there are 10 shares that exhibit a HIGH BEARISH MOMENTUM/APPROACHING OVERSOLD rating. Fewer names are displaying HIGH BULLISH MOMENTUM while none is OVERBOUGHT. This weak market breadth highlights the broad-based selling where a significant number of constituents are back below key moving average (21,50-EMAs) while the index itself is below it's 200-day simple moving average.

As more names have shifted into the approaching oversold range, here's what I am looking for which could signal that a minor rebound is possible: (1) Improving candle structure across several name and sectors for e.g. long lower tails, doji's, piercing candles (2) volume which will signal initial buying interest (3) Numbers 1 and 2 at prior support zones or in line with/extended from key moving average (4) RSI and MACD bullish divergence.

DAX INDEX. Bullish-to-Bearish Reversal in motion. Now in the money by 700 points.

HAR (7%) and GFI (+3.8%) rebound in line with TACTICAL TRADING GUIDE. HAR was also discussed on Monday pre-market.

Wednesday 04-October-2023, 08h17 STRATEGY SCREEN: Shares That Have Been Sold Aggressively and Where A Positive Candle Structure Could Signal a Slowdown Of Selling Momentum. [Medium Term Time Frame, But Remain Cognizant Of The Short Term Time Frame].

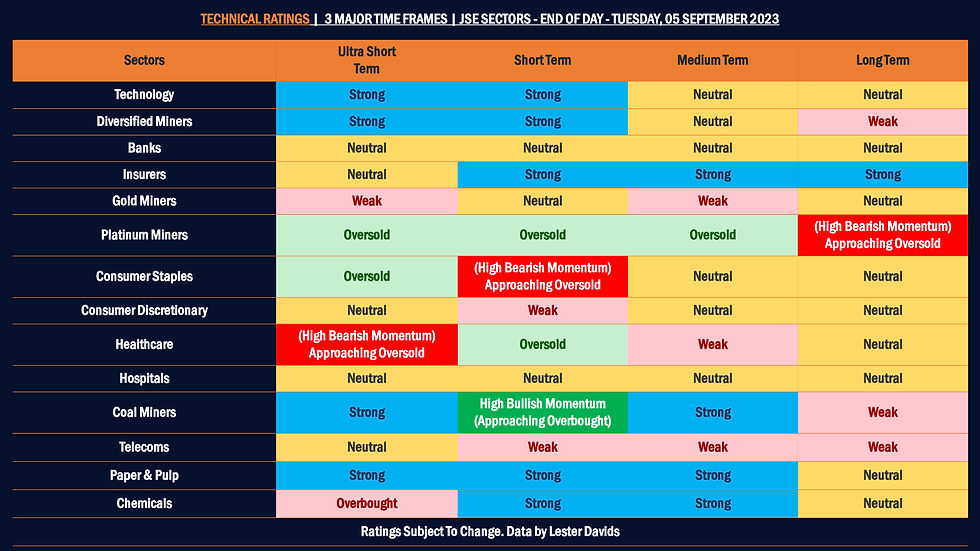

Wednesday 04-October-2023, 06h30 Relative Sector Ratings: 4 Major Time Frames, at yesterday's close.

Wednesday 04-October-2023, 06h30 JSE Technical Summary: Short Term, at yesterday's close.

Tuesday 03-October-2023, 14h40 FX: Tactical Trading Guide.

Tuesday 03-October-2023, 08h08 Update: JSE Top 40 Index. Now down by 11.5% or -8535 points from my note on 24 January titled '6 Factors That Suggested An Appealing Reward-To-Risk For Sellers'. It's also trading at the lowest level since November.

Tuesday 03-October-2023, 07h58 STRATEGY SCREEN (Short Term time Frame): Reward-To-Risk Becoming Attractive For A Small Buy/long Position. Tickers: FSR. MTN, N91, NED, NRP, NY1, VOD

Tuesday 03-October-2023, 07h29 Investec Ltd (INL). Potential Sell/Short Setup.

Tuesday 03-October-2023, 06h30 JSE Technical Summary: Short Term, at yesterday's close.

Monday 02-October-2023, 21h12 Sanlam SLM. Full short/sell target reached during today's trading session. Full gain = 5.7% ungeared. Chart as at 16h24.

Monday 02-October-2023, 06h30 JSE Top 40 Index Q4 Seasonality (20-Year Data). Comments on chart.

Monday 02-October-2023, 06h30 JSE Technical Summary: Short Term

Monday 02-October-2023, 06h30 JSE Coal Miners. Previously I highlighted buy ideas on both EXX at R145 (high of R185) and TGA at R134 (high of R170) while also discussing the equally-weighted relative chart versus the Top 40 Index. This is an updated chart of JSE Coal Miners Relative To JSE Top 40 Index which is a printing it's first test of it's declining 200-day simple moving average (SMA). The combination of ultra short term/short term high bullish momentum/approaching overbought conditions could see a consolidation/minor retracement on a relative basis.

Monday 02-October-2023, 06h30 JSE PGMs Relative To JSE Top 40 Index. A simple price chart highlighting the weekly RSI breaking out. This data point may point to a change of relative trend over the medium term.

Monday 02-October-2023, 06h30 Harmony Gold (HAR, 7103c). For ultra short term traders, the share's declining from it's recent peak of 8580c to it's low of 6997c on Friday may be worth noting. According to Friday's end of day Tactical Trading Guide, the SHORT TERM reading states "aggressive selling, wait for lower time frames to stabilize" while the MEDIUM TERM reading states "persistently weak, however monitor if it can reclaim the prior session lows for a bullish reversal trade". Here, the pivot becomes Friday's lows of 6997c meaning that if the share trades below this level, it would need to reclaim it to support a bullish reversal trade. Note this might not trigger today however traders should be alert to the price action/change in candle structure.

Monday 02-October-2023, 06h30 Woolworths (WHL, 6783c). Approaching short term levels of Interest.

Monday 02-October-2023, 06h30 Richemont Relative To Top 40 Index. Upper Panel= CFR vs Top 40 Index. Lower Panel = 63-Day (Quarterly) Drawdown. The current drawdown is one of the largest we have seen over the past decade.

Monday 02-October-2023, 06h30 STRATEGY SCREEN: Medium To Long Term Time Frame: After A General Downward Trend, Buyers Are Showing Interest (Readings Are Subject To Change Based On The Development Of The Price Action). Tickers: AGL, AMS, MRP, NTC, PIK

(Readings Are Subject To Change Based On The Development Of The Price Action).

Monday 02-October-2023, 06h30 STRATEGY SCREEN (Short Term time Frame): Reward-To-Risk Becoming Attractive For A Small Buy/long Position. Tickers: DSY, GFI, HCI, REM, WHL

(Readings Are Subject To Change Based On The Development Of The Price Action).

Monday 02-October-2023, 06h30 JSE Tactical Trading Guide For The Industrials Sector. To access the other sector, click on the image below.

Monday 02-October-2023, 06h30 JSE Sector Ratings Relative To The Broader Market

Friday 29-Sep-2023, 12h57 FX: Tactical Trading Guide.

Friday 29-Sep-2023, 09h37 Key Market Ratings. To access, click on the following link:

Friday 29-Sep-2023, 06h30 Tactical Trading Guide. To access, click on the following link:

Thursday 28-Sep-2023, 20h16 JSE Technical Summary at today's close.

Thursday 28-Sep-2023, 07h50 Sasol Ltd (SOL). Consider the automated commentary from yesterday's end of day Tactical Trading Guide in conjunction with the chart that follows.

Thursday 28-Sep-2023, 07h50 Sasol Ltd (SOL). Daily Chart With Potential Price Path(s)

Thursday 28-Sep-2023, 07h17 MTN Group (MTN, 11262c). Analyzing different time frames can give you different views. On Monday 11 September I updated my view on the share by including my perspective of the weekly chart which, at 12200c showed the potential for a further resolution to the downside. On Tuesday the share reached a low of 11132c. The weekly chart on Monday 11 September was presented as follows:

Thursday 28-Sep-2023, 07h17 MTN Group (MTN, 11262c). Both the SHORT TERM and MEDIUM TERM readings via the Tactical Trading Guide stated the following at yesterday's close of trade: "Reward-to-risk becoming attractive for a small buy/long position". Over the past two days, we have seen small signs of slowdown in selling momentum, with the share holding near the prior breakout level. Do note that previously traders were alerted to a sell/short idea from an excessively overbought condition above the R140 level.

Wednesday 27-Sep-2023, 19h44 JSE Technical Summary at today's close.

Wednesday 27-Sep-2023, 14h40 Aspen Pharmacare (APN). Full target reached/exceeded on buy/long re-entry trade idea, with the share reaching a high of 18268c today vs the entry range of 16000c/16400c Bank/Take Profit. Chart is 'current'.

Wednesday 27-Sep-2023, 14h09 South Africa 10-Year Bond Yield. To access the full note, please click on the chart below.

Wednesday 27-Sep-2023, 06h30 Dis-Chem Pharmacies (DCP). Next Best Probability Trade Levels. Comments on Slide Below.

Wednesday 27-Sep-2023, 06h30 Tactical Trading Guide: JSE Resources. To access the other major sectors, click on the table below:

Wednesday 27-Sep-2023, 05h51 Key Markets: Ratings

Tuesday 26-Sep-2023, 21h14 JSE Technical Summary at today's close.

Tuesday 26-Sep-2023, 10h44 Update: JSE Top 40 Index. This morning the JSE Top 40 Index was down by 11% from my call at the beginning of the year when I presented a note called: "6 Factors Which Suggests An Attractive Reward-To-Risk For Sellers" (24 January). We saw the market peak three days late on 27-January. Well done to all who took the opportunity to reduce their risk.

Tuesday 26-Sep-2023, 10h17 Strategy Comment: I prefer to take my direction from various statistical and technical data points, which is an attempt to eliminate most of the bias that comes with decision-making/presenting an opinion. On this basis, my idea coming into last week was that financials were likely to get pushed lower before reversing and that miners were likely to be pushed higher before encountering a bearish reversal. We saw this unfold from the middle of the week as market participants opted to bid up financials and offering miners that lead to aggressive selling pressure. Reviewing the summary of the technical screen, there is no clear bias either way, with the majority of shares trading in the neutral category and to a lesser extent, in the weak category while at an index level, the bias has been to the downside, with the market now near a multi-month low and at the lower end of it's year-to-date range, driven by global growth concerns but more so by the pace at which bond yields have continued to rise over the past few weeks. At the time of writing, the US 10-Year is trading above 4.50% - a multi-year high. In terms of breadth (a measure of underlying strength), the majority of major US sectors are seeing less than 20% of their constituents above their 20-day moving averages. Those that are above, but only by a small margin, are Utilities, Energy and Financials. Sticking with breadth, new lows are outpacing new highs by a wide margin.

Tuesday 26-Sep-2023, 06h30 Tactical Trading Guide: JSE Banks.

To access the other major sectors, click on the following link: https://www.unum.capital/post/tactical-trading-guide

Tuesday 26-Sep-2023, 06h30 Truworths Relative To The JSE Top 40 Index. In the upper panel is the price of Truworths relative to the Top 40 Index. When the line is rising, it means that TRU is outperforming the broader market. When the line is falling, it means that TRU is underperforming the broader market. The lower panel shows the ratio's distance vs it's 200-day SMA. While the relative price is in a high bullish momentum phase, it is also possibly approaching an overbought range with the ratio being 30% above it's 40-wk/200-Day SMA. Bottom Line: TRU is nearing an expensive technical level relative to the broader market.

Tuesday 26-Sep-2023, 06h30 Bidvest Group (BVT). Buy/Long Target Has Been Reached - Bank/Take Profit. Chart is 'current/at last close'.

Tuesday 26-Sep-2023, 06h30 JSE Technical Summary of Ratings: Short Term

Tuesday 26-Sep-2023, 06h30 JSE Sector Ratings Relative To The Market

Friday 22-Sep-2023, 06h30 The second leg of my two-part trading thesis for this week came into effect yesterday with resources/mining shares being sold off aggressively following the minor further advance early in the week. As noted at the start of this week: "...While some mining shares are in a high bullish momentum/approaching overbought phase. Here, one scenario is that these share continues to be bought but trades into overbought territory which can provide an opportunity to sell into strength...".

Both AMS and SSW dropping sharply intraday, in line with the Tactical Trading Guide which looked for a short/sell on the failure to hold the prior session highs. Both were highlighted yesterday morning, here

My mining share watchlist at around 3pm yesterday...red, red, red. Anyone take advantage of the opportunity to short/sell?

Friday 22-Sep-2023, 06h30 Pepkor Holdings (PPH). As at the close of yesterday's trading session, the Tactical Trading Guide for the SHORT TERM time frame read as follows: "Aggressive buying but do not chase. Look for overshoot or failure to hold the prior session range highs to short/sell back to the 8-EMA". This means that should the share print a candle that reflects selling into strength ('doji', 'dark cloud cover' or 'bearish engulfing', that could signal the start of a bearish reversal over the ultra short term. Do not that this process could, for example, take 1-4 trading sessions before the potential reversal commences. Candle confirmation required.

Pepkor Holdings (PPH). Do note that previously I alerted to the downside risk on the share in February at 1991c, which was followed by a substantial decline over the following months by reaching a low of 1330c on 30 May. Original chart below (07 February).

Friday 22-Sep-2023, 06h30 Tactical Trading Guide (Top 20 By Market Cap). Readings are subject to change based on the subsequent development the price action.

Friday 22-Sep-2023, 06h30 JSE Short Term Technical Ratings as at yesterday's close.

Thursday 21-Sep-2023, 06h30 At the start of this week I answered a question which I thought some readers would be interested in knowing: "Is it too late to sell/short financials and (2) Is it too late to buy resources shares? As stated: "My answer to those questions will always begin with the following comment: "It depends on your time horizon". Over the ultra short term (1 to 3 days) some banking shares in are in a high bearish momentum/approaching oversold phase. Here, one scenario is that these share continue to be sold off but trade into oversold territory which can provide an opportunity to buy an ultra short term oversold bounce". The first three days of this week was characterized by exactly that. A further (and slight) push into oversold followed by a strong rebound seen on Tuesday and yesterday, with banking shares in particular finding support in their short term oversold conditions while resources shares have started to unwind from their ultra short term overbought conditions (I also highlighted this last week Friday afternoon on the relative sector ratings sheet).

Within the financial sector, I'm slightly disappointed that my short/sell idea on Sanlam has gone back to flat (after being in the money) however Absa shares saw aggressive buying, rising by 6.3% by the close of trade - the BIGGEST gainer on the Top 40 for the session. Yesterday morning, ABG was 1 of 9 shares which I compiled from the Tactical Trading Guide also 1 of 3 shares which stated that the "reward-to-risk was becoming attractive for a buy/long position" (scroll down if you missed the table) This table was highlighted yesterday (pre-market) on this page. Nedbank (NED), which was discussed on Tuesday, also rose from R200 to nearly R209 during over the 2 days. In addition, Growthpoint (GRT), which I highlighted on Tuesday, was higher by over 4% yesterday. Clicks (CLS) exceeded the short/sell target and and developed a bullish reversal to close higher by over 3%. This was in line with buy/long highlighted on this page yesterday morning. On an absolute basis, Netcare has had a few strong sessions, lifting off the lows while (signal at 1300c) while on a relative basis, the long Netcare/short Life Healthcare market neutral (pair trade) idea is now higher by 6.5%. Well done to all who picked up on these moves.

Absa Group (ABG). Daily Chart as at yesterday's close.

Thursday 21-Sep-2023, 06h30 In mining space, the buy/long ideas in AGL and KIO have exceeded their targets and are now in a consolidation phase while Anglogold Ashanti (ANG) is closing in on the short term target of 34800c. At this stage of the short term price trends, traders should be looking to bank/take profit in the name.

Thursday 21-Sep-2023, 06h30 Considering the Technical Summary on this page, there are no names in the approaching oversold and oversold categories. The majority of the shares trade in the 'neutral' and 'strong' categories. In this case, it's more a case of buying retracements into their 8/21-day EMA's, if and when the share price do reach these levels. Some names such as KIO are in a consolidation phase and are yet to retrace to the 8-EMA. To add, we want to buy retracements when the price pulls back into a rising 8/21-EMA Exponential Moving Average.

Thursday 21-Sep-2023, 06h30 Tactical Trading Guide as at yesterday's close. (The automated data was not available via e-mail however I was able to manually extract it. To avoid clutter, I've only included 17 names which I think is relevant. The data covers about 70 to 80 shares ).

Wednesday 20-Sep-2023, 18h13 JSE Sector Technical Ratings as at today's close.

Wednesday 20-Sep-2023, 17h36 JSE Technical Ratings (Short Term) as at today's close.

Wednesday 20-Sep-2023, 08h29 Firstrand Ltd (FSR, 6481c). An optimal level to cover your short position. The share is has been sold off aggressively and at yesterday's low was down by 12.9% (ungeared) from my note on 31-August which highlighted the bearish distance divergence and potential for a short/sell trade (published here). The 7-day RSI is at 7 which is a level that is rarely seen among large cap shares. This bring the short term rating at the last close to oversold. In terms of the technical chart, the share is trading around the prior breakout level.

Wednesday 20-Sep-2023, 06h30 MTN approaching ultra short term levels of interest. The share is down sharply from my previous view in June of selling the overbought conditions above R140, reaching R116 during yesterday's trading session. Further notes on the chart below.

Wednesday 20-Sep-2023, 06h30 MTN Group. My short/sell view, with potential price path, as highlighted in my research on 12 June.

Wednesday 20-Sep-2023, 06h30 Tactical Trading Guide. Time-permitting, I'll start adding comments from the Tactical Trading Guide on this page. Below are relevant comments in 9 highly liquid/large cap names.

Wednesday 20-Sep-2023, 06h30 JSE Technical Ratings (Short Term) as at yesterday's close.

Tuesday 19-Sep-2023, 18h46 TFG - Strong session (+8.3%). Target reached. Bank/Take Profit. The share traded into the buy zone (earnings-related sell-off) then consolidated before rallying.

TFG. Idea as at 05 Sept.

Tuesday 19-Sep-2023, 08h14 Nedbank (NED, 20107c). Technical views on both the short term and long term time frames. View #1 (Short Term): At yesterday's close of trade, the Tactical Trading Guide for the share stated the following for the SHORT TERM time frame: "Reward-to-risk becoming attractive for a buy/long position" while the MEDIUM TERM time frame stated: "Aggressive Selling. Wait for the lower time frames (1H, 2H, 4H) to stabilize". Considering the momentum readings, the short term price trend ranks as oversold while the medium term price trend ranks as high bearish momentum/approaching oversold. Incorporating the 'distance' vs the 50/100-EMA, I've noticed a bullish divergence which often signals a pending reversal. The current pivot is yesterday's low of 20020c. As a risk management measure, I would like to see today's candle confirm that the aggressive selling is starting to slow down which will support the aforementioned readings. Preferably, a 'doji', 'long lower tail', 'bullish engulfing' could be developed which could be an early indication of some buying activity.

Nedbank Group. View #2 (Long Term): Analyzing the weekly chart, I've noticed that the 14-week RSI is at a 3-year low. New highs on the RSI are bullish. New lows on the RSI are bearish. Know your time horizon.

Tuesday 19-Sep-2023, 07h57 Aspen Pharmacare (APN, 17102c). Bullish Reversal, In The Money. The share traded into my preferred re-entry/buy zone of 16000c-16400c (low of 16100c) and has since developed a bullish reversal to close at a 2 1/2-week high of 17102c. The full short term target is around 17600c but traders could also consider reducing into strength.

Tuesday 19-Sep-2023, 07h30 Anglogold Ashanti (ANG, 34191c). The bull flag (discussed here) is playing out, with the share closing yesterday's session at a 5-week high of 34191c and nearing the target of 34880c (from 32350c). Short term traders can look to reduce into strength. According to yesterday's end of day Tactical Trading Guide, the SHORT TERM time frame was as follows: "Aggressive buying but do not chase. Look for overshoot or failure to hold the prior session highs to short/sell back to the 8-EMA." while the MEDIUM TERM time frame stated: "Strong candle structure (bullish attempt) following a generally weaker downward trend".

Tuesday 19-Sep-2023, 07h10 Growthpoint Properties (GRT, 1097c). At yesterday's close of trade, the Tactical Trading Guide for the share stated the following for the SHORT TERM time frame: "Reward-to-risk becoming attractive for a buy/long position" while the MEDIUM TERM time frame stated: "Aggressive Selling. Wait for the lower time frames (1H, 2H, 4H) to stabilize". Considering the momentum readings, the short term price trend ranks as oversold while the medium term price trend ranks as high bearish momentum/approaching oversold. As a risk management measure, I would like to see today's candle confirm that the aggressive selling is starting to slow down which will support the aforementioned readings. Preferably, a 'doji', 'long lower tail', 'bullish engulfing' could be developed which could be an early indication of some buying activity. One scenario is that we could see the price trade below yesterday's low and then reclaim and start to build a base for a bullish reversal trade.

Growthpoint Properties (GRT). For context, the monthly chart (long term view) continues to reflect a multi-year downward trend. The chart/slide below, as discussed in May of this year.

Tuesday 19-Sep-2023, 06h30 Mondi Plc (MNP). The group announced that it has entered into an agreement to sell its last remaining facility in Russia, Mondi Syktyvkar for approximately €775 million. The market's reaction was positive, sending the shares higher by 4.6% at one point during the trading session, reaching a high of 33134c) The move is in line with my previous view for a higher share price (target 33800c), motivated by both technical and fundamental factors, discussed here and here.

Monday 18-Sep-2023, 20h58 Woolworths Holdings (WHL, 703c). With the current macro backdrop, part of my concern with retail shares is (1) the rand-oil price (trading at a multi-month high) and (2) the high uncertainty around loadshedding. The share has continued to trade lower since it's earnings report and is unwinding from it's massive overextension vs it's 200-week moving average (highlighted/discussed on 13/08). Technically, the 29 June swing lows is a short term, level of interest which is in line with the breakout seen in early January. Today's around 13:05pm I requested a short term reading which stated that: "Reward-to-risk is attractive for a buy/long position" while the medium term reading stated that: "Aggressive selling. Wait for lower time frames (1H, 2H, 4H) to stabilize" This could mean that a minor rebound is possible in the ultra short term. (Going forward, to incorporate further risk management, I would prefer to wait for the price action/candle structure to confirm what the automated reading suggesting).

Monday 18-Sep-2023, 18h07 JSE Technical Ratings (Short Term) as at today's close.

Sunday 17-Sep-2023, Pre-Market Asian Session Key Theme: Rotation. In recent weeks I have highlighted 3 charts, presenting the case for a rotation from Financials shares to Resources shares. Last week we saw this scenario unfold with the JSE mining shares outperforming while JSE financial shares lagged/came under pressure. On the long (buy) side, traders were alerted to opportunities in AGL, KIO, TGA, BTI, EXX, APN, DSY, which performed in line with expectations. On the short (sell) side, traders were alerted opportunities in FSR, SHP, RNI, CLS which also performed in line with expectations. SLM is still in play (and in the money), gradually working it's way lower. In terms of market neutral/pair ideas, buy GRT vs sell RDF did not materialize/reverse as anticipated as it continued to trade lower however 'buy BTI vs sell RNI' is higher by 9%, 'buy ANG vs sell GFI' was higher by 10% at one point this week after having surged on Friday. Buy AGL vs sell BHG was higher by 7.8% at Friday's high. To trade, contact the Unum Capital Trading Desk: E-mail: tradingdesk@unum.co.za | Call: 011 384 2923

Monday 18-Sep-2023, 06h30 It might be that someone reading this wants to know: "Is it too late to sell/short financials and (2) Is it too late to buy resources shares? My answer to those questions will always begin with the following comment: "It depends on your time horizon". Over the ultra short term (1 to 3 days) some banking shares in are in a high bearish momentum/approaching oversold phase. Here, one scenario is that these share continue to be sold off but trade into oversold territory which can provide an opportunity to buy an ultra short term oversold bounce. While some mining shares are in a high bullish momentum/approaching overbought phase. Here, one scenario is that these share continue to be bought but trade into overbought territory which can provide an opportunity to sell into strength. Reviewing the sector ratings, my conclusion is that the rotation may only just be getting stated meaning that while prices have overshot in both directions on both the long and short side, the reversal may not be over and are only starting to develop. Know your time horizon.

Monday 18-Sep-2023, 06h30 Click Group (CLS). Portfolio View. The share has continued to position itself below it's 200-week moving average, which, from a portfolio perspective, reflects a significant shift for long term holders of the share. The positioning also reflects an unwind on a fundamental valuation basis, with the share at a 24 price-to-earnings ratio, which is well above the market's and sector's valuation.

CLS - Fundamental Snapshot. P/Earnings at 24x. P/Book at 11x.

Monday 18-Sep-2023, 06h30 Bidvest Group Relative To JSE Top 40 Index. Relative to the broader market, the share is losing it's upward momentum. This suggests a potential shift from overweight to neutral on a relative basis.

Monday 18-Sep-2023, 06h30 Bid Corp (BID, 44631c). Is BID Technically Expensive? Relative to the broader market (using the 200-Day SMA), the ratio recently traded at 21% above the 200-Day SMA. Historically, this has been a range from where the the ratio has started to retrace i.e. at this level traders would look to shift back to a Neutral position (from Overweight). At Friday's close, the ratio's distance was 16%. On an absolute basis among shares with a +R20bn market cap, BID trades with the highest 7-month RSI, that being 80.

Monday 18-Sep-2023, 06h30 MRP vs TRU. Over 3 months, there is a 40% performance gap between the two shares. TRU is higher by 29% and MRP down by 11%. Considering the long term chart highlighting performance, the two shares are highly correlated while the recent performance gap may be opening a market neutral/pair trade in the near term i.e. buy MRP vs sell TRU. Ratio at last close: 1.74

Sunday 17-Sep-2023, Pre-Market Asia Iron Ore Futures (FEF, $122). Although I do keep track of the price, I don't often chart this commodity. Today I will. My last view was in November at $93 where I discussed the weekly chart which was rebounding off a long term demand/supply zone extending back to 2017. Since then we have seen strong upside follow-through with the $130 level being tested in March, followed by a retracement to $97. Since the May 2023 lows, the price has advanced, reaching a high of $123.75. Also noted is the commodity reclaiming a 2-year downward trend line extending back to the July 2021 peak. The 14-Week RSI is at 60, reflecting healthy medium term momentum.

Iron Ore: As discussed at $93 on 25-Nov-2022

Sunday 17-Sep-2023, Pre-Market Asia Macro Ratings

Monday 18-Sep-2023, 06h30 Exxaro Resources. Target Reached. A strong move with the share advancing by 27% over the 5 weeks. The idea was to buy in the R145 range, with a target at R180. On Friday, the share reached a high of +R186. Well done to all who took advantage of the opportunity. As discussed on Monday 08 August. Original slide (thesis and chart) below.

Friday 15-Sep-2023, 17h49 JSE Technical Ratings (Short Term) as at today's close.

Friday 15-Sep-2023, 15h46 JSE Sectors vs the broader market (using the JSE Top 40 Index as a proxy). This data can provide insight into relative sector positioning.

Friday 15-Sep-2023, 07h31 Impala Platinum (IMP). The 8200c level has once again served as a long term 'line in the sand' for the share. In my Special Report last week Monday 04 September, I highlighted 7 charts related to the JSE Platinum and Precious Metals Sector, with one of them being IMP. Here, at the Friday closing price of 9288c, I discussed 8200c as a key level based on my view of the monthly chart. We saw the share trade into this level followed by a strong rebound (+11.6%) to yesterday's close of 9235c. Well done to those who picked up on the move.

Thursday 14-Sep-2023, 19h54 JSE Technical Summary as at today's close.

Thursday 14-Sep-2023, 19h45 JSE Telecommunications Relative To The JSE Top 40. Telco's continue to show relative weakness versus the broader market with the ratio chart. Descending triangle?

Thursday 14-Sep-2023, 19h33 JSE Financials vs JSE Resources Update: The wide gap between Financials and Resources has started to narrow.

The overbought nature of Financials relative to Resources was discussed most recently, on Wednesday 30 August, pre-market.

Below is my comment on the short term perspective at the time.

Below is my comment on the long term perspective at the time.

Thursday 14-Sep-2023, 19h33 The relative chart of JSE Resources/Top40 is back above it's 50-Day Exponential Moving Average (EMA). A strong close today with positive candle structure.

Thursday 14-Sep-2023, 19h33 The relative chart of JSE Financials/Top 40 is looking to break below it's 50-Day EMA. A weak close with poor candle structure.

Thursday 14-Sep-2023, 18h08 Firstrand Ltd (FSR, c). Update. Sold off sharply on the back of results (-3%). Today the share tested a 2-month low of 6788c and is down by 8% from my note on 31 August when it traded at 7381c. The price/distance method was used to identify the pending weakness. Original chart below, as published on this page.

Thursday 14-Sep-2023, 17h51 Sibanye Stillwater (Update). The Tactical Trading Guide is a value-added tool that can help you, as a trader, manage risk and uncover potential trading opportunities. Today SSW closed higher by 7.96%. As I wrote on yesterday (Wednesday), last Friday's end of day Tactical Trading Guide (automated comment) stated that the 'reward-to-risk was becoming attractive for a small buy/long position'. I have highlighted this on the chart. The previous day (Thursday 07 September), the reading was as follows: "Very Weak. Wait Until It Stabilizes On The Lower Time Frame i.e. 1H, 2H 4H etc.)". The day before that (Wednesday, 06 September), the reading was as follows: "Very Weak. Wait Until It Stabilizes On The Lower Time Frame i.e. 1H, 2H 4H etc.)". And the day before that (Tuesday, 05 September) is also stated: "Very Weak. Wait Until It Stabilizes On The Lower Time Frame i.e. 1H, 2H 4H etc.)". All of these readings for the aforementioned days are available on request or can be accessed in live environment on the telegram group. The Tactical Trading Guide is a powerful tool that is available to clients and helps to manage risk and uncover opportunity. If you are not a client but have stumbled across this page and would like access to continuous research insights, get in touch today > lester@unum.co.za

Thursday 14-Sep-2023, 11h54 Kumba Iron Ore (KIO, 47343c). The share higher by nearly 10% thus far today. Target Exceeded. Bank/Take Profit.

KIO Original Chart as at Monday 11 September (Pre-Market).

Thursday 14-Sep-2023, 11h50 Anglo American Plc (AGL, 50489c). Target Exceeded. Bank/Take Profit.

Thursday 14-Sep-2023, 08h48 Glencore Plc Relative To The JSE Top 40 Index. PORTFOLIO VIEW (Relative). Previously, I highlighted the share's monthly MACD having developed a bearish cross, while in the short to medium term, 11250c was a level at which clients were alerted to a sell/short. Considering relative chart of the share vs the JSE Top 40 Index, it may be worth noting that the ratio continues to consolidate below it's 200-day simple moving average. This consolidation range is consistent with the swing highs seen in 2014. Bottom Line: The move and consolidation below the 200-day SMA may indicate that the investors with a medium term portfolio should be shifting to a neutral view position vs the broader market.

Thursday 14-Sep-2023, 08h30 JSE Technical Summary as at yesterday's close.

Wednesday 13-Sep-2023, 17h44 JSE Sector Ratings as at today's close.

Wednesday 13-Sep-2023, 08h14 Sibanye Stillwater (SSW, 2681c). On Monday and yesterday, the share stabilized to a certain extent, temporarily halting it's downward. The minor buying is in line with the Tactical Trading Guide as at end of day on Friday, which stated: "Reward-to-risk becoming attractive for small buy/long position". I don't expect a massive surge but rather a continued attempt to stabilize in the short term. Friday's end of day data snippet is highlighted below followed by the current chart.

Wednesday 13-Sep-2023, 07h52 Momentum Trends. This screen considers the momentum over 4 time frames i.e. 1, 2, 3 and 4 days, with a 7-day RSI as the indicator. Green = Strengthening. Red = Weakening. Coverage: JSE Top 40 Constituents

Wednesday 13-Sep-2023, 07h47 Richemont (CFR). FLASH COMMENT: A short term view via a long term chart. The share has unwound significantly over the 3 months. Considering the monthly chart, the share is nearing it's previous breakout level which could act as a temporary support zone. This level is also in line with the 21-month exponential moving average.

Tuesday 12-Sep-2023, 20h59 Brent Crude Oil. We have seen a significant move over the past 9 weeks, with Brent higher from $75 to $92. The short term trend is strong with the commodity recently having cleared resistance of a 9-month base. While the trend is up, traders should are alerted to the momentum indicators which may indicate the price nearing overbought conditions, with the 7-day RSI at 80 and the 14-day RSI at 73. In the short term, the buy/long side reward-to-risk is becoming less appealing vs prior weeks.

Tuesday 12-Sep-2023, 18h38 Kumba Iron Ore (KIO, 42951c). The share did not trade below Friday's low, instead it found early strength on Monday (developing a 'doji' candle formation by the end of the session), followed by a strong move on Tuesday (+4.9%). There are tactical opportunities for short term cash flow.

Tuesday 12-Sep-2023, 17h55 My comment today for Bloomberg on DSY's Trading Statement.

Tuesday 12-Sep-2023, 17h39 JSE Technical Summary as at today's close:

Tuesday 12-Sep-2023, 14h05 The JSE Life Assurance Sector is approaching overbought levels relative to the JSE Top 40 Index. Considering the distance of the ratio chart vs the 200-day SMA, sector trades 13% above the moving average. This is the highest level since 2019 (as far the current data goes back). Why is this chart relevant? For traders who currently hold life insurers or are overweight the sector, the distance vs the 200-day SMA may indicate an overextension and that a pullback from at or around current levels is possible. Alternatively, if for investors who have been overweight the sector, it may be an opportunity to shift to an equal-weight position.

Tuesday 12-Sep-2023, 07h19 Anglogold Ashanti (ANG, 32350c). Potentially developing a small, short term bull flag formation. Needs confirmation above upper boundary of channel. The automated readings from yesterday's end of day Tactical Trading Guide are highlighted on the chart.

Tuesday 12-Sep-2023, 06h30 US Dollar Index (DXY). As we approached yesterday's trading session, my pre-market view was that the USD was nearing short term overbought levels and that a pullback would create a tailwind for equities. Yesterday the Dollar fell the most in two weeks, supporting the move higher in equities, both locally and offshore.

Monday 11-Sep-2023, 19h34 The Foschini Group (TFG, 9588c). Out of the 11 retail-related shares that populates my watchlist, TFG was the biggest gainer during today's session. The share traded into the provisional buy zone of 9158 and 9224c followed by a rebound to test a high of 9607c. As noted last week Tuesday: "...Nobody knows how institutional investors will react, however should the share be sold off substantially, a speculative opportunity may be presented...".

As discussed on this page last week, my original trading plan for TFG, last week:

Monday 11-Sep-2023, 19h26 Telkom (TKG, 2418c). HIGH RISK, SPECULATIVE VIEW. Reviewing today's end of day tactical guide, the following automated commentary is stated. SHORT TERM: "Reward-to-risk becoming attractive for a small buy/long position". MEDIUM TERM: "Aggressive selling. Wait for lower time frames to stabilize". My manual review of the chart notes the strong sell-off as well as the potential for further downside in the ultra short term. While this is the case, traders could consider the following price action scenarios: (1) The share trades below the prior session lows however, buyers step in and reclaim the lows (piercing candle), setting up a bullish reversal. (2) The share trades lower and goes on to test the 17 and 19 May lows where buyers step to accumulate in an oversold range. Note: I know some guys are looking at this as a value play based on the underlying assets which could unlock value for s/holders. I also know this share isn't a sector leader, thus my view is speculative.

Monday 11-Sep-2023, 18h45 Anglo American Plc (AGL, 49351c). Strong follow-through reversal today (+2%) from Friday's reversal candle. The share traded into the provisional buy zone of 48000c to 48300c followed by a rebound to test a high of 49862c during today's trading session. No model is 100% accurate but the data is acting as a guide to finding potential opportunities and managing risk.

Monday 11-Sep-2023, 18h35 JSE Technical Summary as at today's close:

Monday 11-Sep-2023, 17h28 MTN Group. (MTN, 12168c). Further to this morning's comment on the share. Monday saw a poor close, woth a bearish engulfing candle combined with a pennant structure. The share price remains below (and in close proximity) to it's declining 8, 21 and 50-EMA's. This confirms that the path of least resistance is downward.

Monday 11-Sep-2023, 06h30 Kumba Iron Ore (KIO, 40551c). Going forward, the new and temporary pivot is Friday's low of 39856c. Should the price trade below this level on Monday, traders want to see the lows being reclaimed to in order for a reversal to be confirmed. Although being earnings-related, an example of reclaiming the prior session lows is the price action on 24 July followed by the advance when the company reported earning the following day (25/07). Should the price action continue to deteriorate in the ultra short term, the case for a bullish reversal will be ruled out. [As per the Tactical Trading Guide, the readings for the three time frames are as follows: SHORT TERM > Very weak, wat until it stabilizes on the lower time frame. MEDIUM TERM > Very weak, wait until it stabilizes on the lower time frame. LONG TERM > Very weak, wat until it stabilizes on the lower time frame.

Monday 11-Sep-2023, 06h30 Aspen Pharmacare (APN, 16458c). Has been sold off aggressively post earnings and but has started finding support in the 160/164 re-entry range (highlighted last week on this page). Short, medium and long term comments from The Tactical Trading Guide have been highlighted on the chart (subject to change as the price action develops).

Monday 11-Sep-2023, 06h30 MTN Group (MTN, c). The short term trend is down while the medium term trend is sideways. To elaborate, the share price has been in a range for well over a year with sellers controlling the tape at ~R150 and buyers stepping up at ~R110. Upon an enquiry from a client during last week, my view was that the R116 level could offer a short term accumulation zone for a short term rebound. Two charts are highlighted below. The weekly, where I have zoomed out and the daily for a closer view on the short term levels.

MTN Group Weekly Chart: Consolidation With A Potential Resolution To The Downside Over The Medium Term.

MTN Group Daily Chart.

Monday 11-Sep-2023, 06h30 Sasol Ltd (SOL, 24444c). In the short to medium term, the Sasol share price offers almost little to no opportunity for those who are looking to be exposed to a strong trend. Since the beginning of the 1st quarter, the share has been range-bound meaning that making money in the name has been tricky. The company's share price was recently upgraded by certain institutions(s) to buy/overweight, which suggests that the analysts are expecting a higher share price vs the current level. Most recently, I published a short term view, expecting the share to retrace, followed by a rebound. We saw this materialize with the share trading into the buy zone at R232 followed by a rebound to R259 (+2700c or +11% ungeared). Looking more broadly, the aforementioned range sees resistance at around R270 and support at R220. On the downside, breaching R220 with conviction could open up R195 while getting through R270 (with conviction) would open up R325 as a potential medium term target. In both case, I would like to see the technical indicators confirm the moves.

Sasol vs ZAR/Oil Price. Looking at the 10-year performance, SOL now trades at the widest spread vs the Rand-Oil Price. The performance trends are highlighted on the chart below.

Monday 11-Sep-2023, 06h30 Market Neutral. Potential Pairs Trade Opportunity by buying ANG vs selling GFI. See the 6 month performance gap (ANG +3.47% vs GFI +42.83%).

Monday 11-Sep-2023, 06h30 Exxaro Resources (EXX) vs African Rainbow Minerals (ARI) Reviewing more of these pair opportunities, the gap between EXX and ARI is quite substantial. Over the long, you'll note that the pair highly correlated however over the short term, EXX has outperformed ARI by a significant margin. While I have discussed the strength in the coal names (EXX, TGA), there could be an opportunity for a pair trade i.e. buying ARI vs selling EXX. See the 1-month performance below:

Monday 11-Sep-2023, 06h30 JSE Technical Summary as at Friday's close:

Monday 11-Sep-2023, 06h30 JSE Sector Ratings as at Friday's close:

Monday 11-Sep-2023, 06h30 Shoprite Holdings (SHP). Update - Sold off aggressively on the back of results last week Tuesday. Down from R262 to R237. The overbought conditions and alignment of the parallel channel acting as a barrier to upside/a reason to distribute the share. Well done to all who traded this on the short side. My slide as at last week Monday before the big drop.

Monday 11-Sep-2023, 06h30 Capitec Bank (CPI). Technically, I initially had a level in mind for clients to re-enter on this pullback (see markings on the chart) however the company released a voluntary trading statement on Friday indicating that Headline Earnings Per Share would be higher by between 8% and 10%. At one point today the share was higher by as much as 9.1% which means that the share did not trade into my provisional re-entry range. I'm not here to interrogate the meaning behind the movement however the daily price change does appear excessive considering the less-than-stellar HEPS forecast. I expected a rebound but that was a STRANGE MOVE!

Sunday 10-Sep-2023, Pre-Market Asian Session. US Dollar Index (DXY). Stronger Dollar = Weaker Equities. Weaker Dollar = Stronger Equities. At current levels, the USD is in a strong upward trend, reflecting high bullish momentum while also approaching short term overbought levels. A pullback in the USD could be a tailwind for equities.

S&P 500 Index (SPY) vs US Dollar Index highlighting the inverse correlation.

Friday 08-Sep-2023, 06h36 Investec Ltd (INL). The incline hasn't been broken as yet, however, losing the trend line support could signal a change of trend and commence a potential bear flag structure.

Friday 08-Sep-2023, 06h21 Reinet Investments (RNI). Bank/Take Profit on short/sell idea. Now trading at R400 (from R422), at a 2-month low. Original setup below.

Friday 08-Sep-2023, 06h15 Short Term Technical Ratings as at yesterday's close (below)

Friday 08-Sep-2023, 06h08 JSE Sector Ratings as at yesterday's close (below).

Thursday 07-Sep-2023, 20h34 AVI Ltd (AVI). Previous bull flag formation in late July saw great upside follow-through. Consumer squeeze placing significant pressure on discretionary spending hence we could see a short term pullback. (Alternatively, wait for a deeper pullback to re-enter on the buy/long side).

Thursday 07-Sep-2023, 20h16 Bidvest Group. Selling has been aggressive (price down from R297 to R264 in a few sessions). Price Action Scenario #1 below.

Thursday 07-Sep-2023, 20h16 Bidvest Group. If the price action continues to deteriorate then I will look at the 2nd support zone. Price Action Scenario #2 below.

Thursday 07-Sep-2023, 18h04 NTC vs LHC. To my earlier comment on NTC, below is the 3 and 6 months performance with sector peer LHC - SIZEABLE GAP.

Thursday 07-Sep-2023, 17h39 Netcare Ltd (NTC, 1300c). The selling has been relentless and this may not be the extact bottom however today's candle (at the previous swing low) was enough for me to take note of a potential trading opportunity. The candle structure in question is a long lower tail, at support, within an oversold range. I'd like to see the share stop going down, then develop a base which can lead to a bullish reversal.

The share is down from my previous short/sell idea at 1620-1635c to today's multi-month low of 1262c (-22%).

NTC short/sell idea as presented on 29/04.

Thursday 07-Sep-2023, 16h04 Redefine Properties RDF (Absolute). Lower highs + candle structure deteriorating.

Thursday 07-Sep-2023, 15h50 Market Neutral/Pair Comment. Growthpoint Properties vs Redefine Properties. GRT has underperformed RDF over 3 and 6 months. See the charts below (To reduce market risk, the idea would be to buy GRT while simultaneously selling an equivalent amount of RDF to remain market neutral).

GRT vs RDF | 3 Months Performance Trends

GRT vs RDF | 6 Months Performance Trends

Thursday 07-Sep-2023, 13h52 Anglo American Plc (AGL, 48426c). Comments on chart below.

Thursday 07-Sep-2023, 09h02 FX: GBP/JPY (184.19). A substantial divergence is being develop with the price being in an upward trend (higher highs) while the distance vs it's 50/100-EMA spread is print lower highs. This is a pending short/sell setup.

Thursday 07-Sep-2023, 08h53 Impala Platinum (IMP). Reviewing the Tactical Trading Guide (Automated Price Action Analysis) for the end of day on Wednesday 06-Sept-2023, the following was noted: SHORT TERM: "Reward-to-risk becoming attractive for a small buy/long position". For context, the previous day's SHORT TERM reading was as follows: "Sellers in control. Wait for the price to stabilize before considering a buy".

Thursday 07-Sep-2023, 08h44 Discovery Holdings (DSY). The automated trading commentary of 27/08 stated: "Aggressive Buying But Overbought On Lower Time Frame-Expect Consolidation or Minor Retracement". We have since seen a move from above R158 to yesterday's low of 14472c, in line with the model. The recent swing lows seen at 28 June and 11 July is a next provisional level of interest for short term traders. Should this be accompanied by oversold or near oversold conditions, this would support the case for a short term rebound. Do note that event risk looms with earnings due today 07 September.

Thursday 07-Sep-2023, 08h19 DAX Index. Bullish-To-Bearish Reversal As Evidence of Distribution. A directional shift may be underway with the following as key drivers: (1) Price trend has breached 8-month incline support (2) the 50-day EMA has started to act as a resistance level while also turning down (3) The daily MACD is below it's centre line while the 3-day MACD Level and Signal lines have a negative alignment combined with a pending cross below the centre line (4) Also noted is development of a potential minor bear flag formation. Risk Level: 15516. Potential Downside Target: 14660.

Wednesday 06-Sep-2023, 18h23 Click Group CLS (Update). The share has closed in on the downside/short target price of 26382c today, with a print of 26546c. The entry range (time of publication was 27791c). Traders can look to bank/take Profit. Alternatively scale out of the position. I discussed this setup last week Thursday on this page. The original chart is shown below:

Wednesday 06-Sep-2023, 17h33 Technical Ratings as at today's close.

Wednesday 06-Sep-2023, 07h14 Truworths Intl (TRU). Via my Tactical Trading Guide, yesterday's end of day price action readings were as follows: SHORT TERM: "Strong upside move but momentum slowing with sellers becoming active." MEDIUM TERM: "Do not enter buy/long here. The reward-to-risk is unattractive." Both the short term and medium term readings are shown below. This is subject to change as the price action develops.

TRU SHORT TERM

TRU MEDIUM TERM

Wednesday 06-Sep-2023, 06h15 JSE Sector Ratings as at yesterday's close.

Tuesday 05-Sep-2023, 21h46 Just after the close today, TFG released a trading update and trading statement. HEPS to decline by between 15% and 20%. Nobody knows how the institutional investors will react, however should the share be sold off substantially, a speculative opportunity may be presented. The chart below highlights my provisional, speculative view for a potential trading opportunity. This is not a prediction, just a note so that traders can be prepared should an opportunity arise.

Tuesday 05-Sep-2023, 21h16 SA Fear and Greed Index vs SA Financials. SA Financials starting to align with both the currency and bond markets as evidenced by the gap which is looking to be closed. Financials (a partial representation of SA-Inc) now starting to trade in line with what is being reflected in the currency and bond markets.

Tuesday 05-Sep-2023, 20h45 Woolworths Holdings (WHL, 7184c). Potential long re-entry on the short term time frame. Notes on the chart below.

For some context, this is what the Momentum Trends (MT) look like for WHL on multiple time frames.

Tuesday 05-Sep-2023, 18h20 Technical Ratings at today's close.

Tuesday 05-Sep-2023, 15h01 Harmony Gold via SENS in the last few minutes...It might be worth noting that Lingotto Investment increased their stake above 5%. Who is Lingotto?...They're owned by Exor whose majority owners are Agnelli family who have a good track record of capital allocation. You might recall a few years ago they also had a stake in Sibanye Stillwater which they sold in 2018.

Tuesday 05-Sep-2023, 08h55 Shoprite (SHP). Has reported results for the 52 weeks ended 02 July 2023. '...great business in a tough environment, but this feels light relative to the current valuation (23x earnings)...'

Tuesday 05-Sep-2023, 08h52 Aspen Pharmacare (APN). Speculative View: "...trading at prior support/swing low, in an oversold range. I'm expecting the share to trade lower however traders need to monitor for evidence of buying which could be reflected via a bullish candle formation i.e. 'long lower tail', 'doji', 'inverted hammer..."

Monday 04-Sep-2023, 20h48 Sanlam Ltd (SLM). The share has advanced strongly, moving into an overbought range, with the 7-day RSI at Friday's close, the 14-day RSI at 71 and the 7 week RSI at 73 at last week's close. While the strength is evident, today's candle formation may have been an early sign of a loss of upside momentum, with the development of a 'dark cloud cover' as well as a close at the lows of the day. The aforementioned points to the potential for a sell/short setup however event risk in the form of earnings due on Thursday 07 September makes the setup slightly complicated as the share could continue it's rally when earnings are reported. Traders who are looking to embrace the opportunity to sell/short could potentially apply smaller-than-average position sizes to reduce the risk of the trade. Note: The short & medium term automated end of day readings are highlighted on the chart below.

Monday 04-Sep-2023, 20h48 Sanlam Ltd (SLM) | Price Distance vs 200-Day SMA

Monday 04-Sep-2023, 18h30 Short Term Technical Ratings at today's close.

Saturday 02-Sep-2023, 18h52 JSE Sector Ratings as at yesterday's close.

Saturday 02-Sep-2023, 12h55 Brent Crude Oil (Update). Strong upside follow-through (+18.3%).

Saturday 02-Sep-2023, 12h15 Richards Bay Coal Futures. This updated chart is important and relevant to both EXX and TGA. The previous demand/supply zones of $91 has held and while the $109 level has been reclaimed. The short term price structure is positive and points to the commodity being in a recovery phase.

Friday 01-Sep-2023, 18h00 JSE Top 40 Index. The previous deeply oversold condition was met with a rebound over the two weeks. We have since seen the price reclaim the prior lows, and while this level is being held, it remains to be seen whether this previous demand zone can be retained as a support zone. The index remains below it's 21-day and 50-EMA (short and medium term trends) as wll as below it's 200-day simple moving average. Following early strength during today's session, gains were eroded with a 'doji' candle being developed by the end of the session. Traders should also note that the rejection off the highs of the day is in line with the downward trend line which extends from the short term peak on 01 August 2023. Current Rating: Neutral.

Friday 01-Sep-2023, 11h30 Capitec Bank (CPI). PORTFOLIO VIEW. Relative to it's peer group, using the Satrix Financial ETF as a proxy, the 20-year relative bull trend is being breached with the upward trend which commenced in November 2003 having been breached.

Friday 01-Sep-2023, 05h33 Global Sentiment Index. The index is turning up in according with the projection.

Thursday 31-Aug-2023, 12h51 FSR Firstrand. Month-end rebalancing may be having an effect which is seeing larger-than-average moves. While this is noted, analysis of FSR detects a bearish 'distance divergence' of the price vs the 50/100-EMA spread. With the Rand on a weakening path we could see extended local-facing names come under retrace from their highs, opening up a potential sell/short trade.

Thursday 31-Aug-2023, 10h10 CLS Clicks Group. Scanning for further opportunities in early trade, I've noticed a rising wedge technical formation, which is a considered bearish (negative). Also noted is the price struggling to reclaim the previous breakdown level. Further confirmation for a sell would be the share losing the incline support and the 7-day RSI shifting below the 50 level.

Thursday 31-Aug-2023, 08h39 1NVEST Rhodium ETF (ETFRHO). A distance divergence has been identified where the price has traded in a sideways consolidation while the distance vs the 200-day simple moving average has started to develop a higher low. This is an early positive signal for a potential recovery opportunity.

Traders should also consider the position of the monthly chart which highlights the ETF trading at a key support level.

Wednesday 30-Aug-2023, 21h16 JSE Sector Ratings as at today's close.

Wednesday 30-Aug-2023, 20h13 British American Tobacco (BTI) vs Reinet Investments (RNI). I continue to favour a technical turnaround in BTI with a buy/long idea at 60795c. Looking at BTI relative to RNI, there could also be a market neutral/pair trade opportunity i.e. BUY BTI vs SELL RNI. A directional change appears underway as the price emerges from a medium term channel.

Wednesday 30-Aug-2023, 14h42 FX: AUD/USD. Full target reached at 0.6500. Idea closed.

Wednesday 30-Aug-2023, 11h13 Truworths (TRU). The previous inverse head and shoulder technical formation has been completed with the share exceeding the technical target. At current levels, the following is note: (1) a potential double top technical formation where 7200c is a resistance zone. At the time of writing, the candle structure reflects a 'dark cloud cover' formation which is considered bearish. (2) Also noted is the price trading 13% above it's 75-day Exponential Moving Average which is (i) extended to the upside and (ii) printing a 'distance divergence'. This is often viewed as a precusore to potential price weakness. Bottom Line: The current price level is unappealing from a buy/long reward-to-risk perspective.

TRU Reference Inverse Head and Shoulder Technical Formation. Active Trading Plan Monday 03 July 2023

Wednesday 30-Aug-2023, 09h25 Woolworths (Update) Within the first 30 minutes of trade, the share is lower by 4.7% on the back of reporting results for the 53 weeks ended 25 June 2023. The unwind is in line with my comment on 14 June highlighting the share's distance (overextension) versus it's 200-week moving average and where the upside reward-to-risk was unappealing.

Wednesday 30-Aug-2023, 09h25 Woolworths (Update). The sell-off is also in line with my previous sell scenario via the Active Trading Plan.

Wednesday 30-Aug-2023, 08h56 JSE Consumer Staples Relative To The JSE Top 40. Potential double top technical formation + lower highs on both the MACD and the RSI. See my previous comment on SHP (Quality However Approaching Slightly Expensive Fundamental and Technical Level.

Wednesday 30-Aug-2023, 08h37 Richemont (Update) The short entry was missed by a few points however share reached the downside target and has since developed a short term base, with a early signs of buying interest.

Wednesday 30-Aug-2023, 08h37 Richemont. As per my comment in 17-August, the swing low was in focus as a potential re-accumulation zone. As mentioned above, a short term base has developed, with a early signs of buying interest. The 14-Day RSI is starting to move up from an oversold zone while a MACD bullish crossover is imminent.

Wednesday 30-Aug-2023, 07h53 JSE Financials (via Satrix FINI) vs JSE Resources (via Satrix RESI). Distance vs 50-day SMA being printed with negative divergence (SHORT TERM):

Wednesday 30-Aug-2023, 07h53 JSE Financials (via Satrix FINI) vs JSE Resources (via Satrix RESI). Distance vs 200-Week EMA being printed with negative divergence (LONG TERM).

Tuesday 29-Aug-2023, 20h27 Platinum. This evening, the commodity trades at a 5-week high, having rallied by 7.9% since last week Sunday's update (pre-market Asia). At current levels, short term traders could consider reducing into strength. The chart is current. Original comment here: https://www.unum.capital/post/platinum

Tuesday 29-Aug-2023, 11h24 JSE Coal Miners. Further Update. Relative to the broader market, using the JSE Top 40 Index as a proxy, the sector continues to reflect early stages of relative strength. Plotting a ratio chart for Equally-weighted Coal Miners vs JSE Top 40 Index, the following is noted: (1) The ratio is firmly above the 50-Day Exponential Moving Average. This follows the 50-Day EMA acting as a headwind over several months. (2) the 14-day RSI is printing new multi-month highs. This is a feature of emerging strength. (3) The MACD and Signal Line (upper panel) has shifted above the centre line. This is a feature of potential change of trend. Bottom Line: Following several months of underperformance, the sector may be experiencing a change of trend relative to the broader market. For EXX, we have seen a strong recovery move over the 3 weeks (from ~14900c to 16700c - discussed here on 07-Aug: https://www.unum.capital/post/exxaro-resources-monday-07-august-2023 ) while the TGA buy/long idea saw the price fluctuate between 12800c/13500c before testing a high of +15300c today (trading around a 2-month high). This morning TGA announced the completion of the transaction to acquire a controlling shareholding in the Ensham coal mine.

Monday 28-Aug-2023, 21h25 JSE Platinum & Precious Metals. Price action improving. Every once in a while you should run a simple screen and check the price distance vs it's 200-week SMA. This gives us view on how technically cheap or expensive a share is. Last week Wednesday, the PGMs populated the cheap end of the list and from late last week we started seeing buying activity in the sector off heavily depressed levels. Northam Platinum with a R1bn share buyback program should provide a temporary bid in that name

Monday 28-Aug-2023, 20h46 JSE Diversified Miners vs JSE Top 40 Index. The price action could improve before the news gets better. Last week we saw some resource shares stabilize (AGL and PGMs) which is in the midst of the ongoing Chinese economic weakness. My underweight view of sector vs the broader market (22 November 2022) has gone well beyond expectations with the sector subsequently being a serial underperformer (-19% over the period). I will acknowledge that I can't pick the bottom however we can rely on a combination of factors that help us assess when the reward-to-risk is appealing. Going through the 'Distance' charts, I've noticed the ratio (Miners vs Top 40) has developed a lower low while the distance vs the 200-day SMA is relatively 'flat' (a positive divergence). Most names acted well today. It looks like that 475-ish level on AGL has held again. If you go back, that was previously a major support zone.

Monday 28-Aug-2023, 19h56 Sasol (SOL) Closing in on short term target. The share traded into my provisional re-entry zone which was subsequently followed by a bullish reversal (up between 1100c and 1200c). Short term traders would be looking to reduce into the strength.

Monday 28-Aug-2023, 12h40 JSE Banks. Relative breakdown vs JSE Top 40. if you're shorting bank shares or are looking to build a position, this is the kind of technical data that might support that view. The medium term relative outperformance of banks relative to the broader market is starting to wane with the ratio below the 21-day EMA for the first time since 07 June. This chart is in line with my previous relative view which saw the price advance into a declining 200-day SMA: https://www.unum.capital/post/jse-banks-vs-jse-top-40-a-logical-level-for-a-pause-wednesday-02-august-2023

Monday 28-Aug-2023, 11h08 Fundamental Screen. My data services provider, TradingView, has started improving their offerings which is allowing us to access higher quality data. In addition to the technical data, the fundamental screens provide an alternative view with regard to potential opportunities. Currently, I'm running a screen which highlights the following: (1) 'YoY Debt Growth' - we want to see this declining. (2) YoY Free Cash Flow Growth % - we want to see this increasing (3) Dividend Payment Ratio % - I preferred a low payment ratio as it might imply that there is room for dividend growth (4) Debt-to-Equity Ratio - the lower, the better. The current screen is sorted by FCF % Growth.

Monday 28-Aug-2023, 09h55 Spar Group (SPP, 10429c). In early trade, I'm picking up a few names on my 'Swing Screen'. One of them being Spar which may be in the process of developing a bull flag structure where a breached of the channel resistance could open up 11100c to 11400c.

Sunday 27-Aug-2023, 16h42 Market Neutral (NED/SBK). If you're following market neutral strategies then I'd like to bring your attention to the 1-year performance gap between NED (+0.59%) and SBK (+23.76%). It's hard to tell whether this spread will continue to widen in the short term however, it may be worth bearing in mind for mean reversion trade (i.e. buy NED vs Sell SBK).

Sunday 27-Aug-2023, 14h01 FX: EUR/USD. High bearish momentum /approaching oversold. Potential buy/long trade.

Sunday 27-Aug-2023, 13h45 Prosus (PRX) is approaching dual support in the form of (1) a declining trend line which has acted as a buying zone and (2) the prior swing low of 13 to 20 March. Considering the share has been in a short term downward trend and has a high bearish momentum/approaching oversold rating at it's last close, traders should consider the potential for a bullish reversal in the near term. What can happen? We could see the price trade lower potentially followed by a candle that suggests a slowdown in bearish momentum. For example, a 'long lower tail', a 'doji' or 'piercing' candle where the share opens lower then reclaims the prior session low on an intraday basis. The yellow arrow on the chart highlights a potential price action scenario.

Sunday 27-Aug-2023, 12h29 BHG Group. You may have seen further news this morning around Chinese industrial profits down 15.5% for the period January-July 2023. BHG - has been reflecting the poor Chinese data/sentiment. Next potential re-accumulation around 47700c to 48500c. Daily Chart.

Saturday 26-Aug-2023, 17h36 South 32 (S32) is down by 20% from my view in May at 5201c where I highlighted the potential for a bear flag over the medium term.

Where to next for South 32 (S32)? I'm watching 3850c to 3930c as a potential re-accumulation zone.

Friday 25-Aug-2023, 16h26 Shoprite Holdings (SHP). Fundamental Valuation: At 23x Earnings, It's Expensive, But Not Excessive. Considering the quality of the business/management and the fact that it's continuing the grow it's market share, the share deserves it's premium fundamental rating. That being said, the technical reward-to-risk has become less and less appealing for the short term traders. I previously highlighted the share at R203 when it traded at the lower boundary of the channel and well below it's 50/100-EMA range, which was the major technical signal that the share was excessively oversold at the time. We are now seeing the opposite with the price at the upper boundary of the channel and around 9% above the mid-point of the 50/100-EMA range i.e. the 75-day EMA. At at the time of writing (just before the close on Friday), the share is print a bearish engulfing candle, with a minor divergence on both the MACD and 14-Day RSI. Early days, but this might be shaping up for a short/sell.

Friday 25-Aug-2023, 13h38 Nasdaq 100 Index Future. Previously I discussed the rising wedge technical formation, which has subsequently been breached to the downside and where a back-test of the channel support was met with a sharp rejection. This may suggest a continuation of the short term downward trend which would coincide with the larger rising wedge structure. The unfilled gap at 14503 is recognized which supports the potential for further downside which the price is also wrestling with the 50-day EMA which has been flat and may also start to turn lower. Also recognized, but now highlighted, is the MACD which has crossed below the centre line for the first time since January 2023. While the bearish factors outweigh the bullish factors from technical standpoint, it should also be noted that a rising wedge formation can also mean a pause of a bull trend where the market consolidates before the next move higher. I am keeping an open mind and watching further price actio developments.

Friday 25-Aug-2023, 11h00 Grindrod (GND). Strong numbers reported for the 6 months to 30 June 2023. The market is responding positively with the share now trading at it's highest level since March, with high thus far today of 1048c. The continued strength is in line with my fundamentally-driven thesis presented just under 2 years ago on 05 October 2021 at 488c and where some of the drivers were as follows: (1) Public-Private Partnership (2) Disposal of certain assets (3) Peer group corporate activity (4) Substantial discount to it's Net Asset Value.

GND original chart on 05 October 2021 at 488c

Thursday 24-Aug-2023, 14h04 USD/ZAR. The pair has reached/exceeded my downside target of R18.55/R18.60, from the initial comment at R19.08. The pair is re-testing a previous recognizable demand supply zone from where we have started to see a minor ultra short term rebound. The current level is also in line with the mean of the 2 standard deviation, 50-day linear regression trend channel.

Thursday 24-Aug-2023, 08h53 Naspers NPN. Yesterday's medium term pre-market reading for the share states the following: "Broadly a weak to sideways consolidation. Has recently been sold. Expect a small rebound".

Prosus PRX medium term reading as at yesterday's close states the following: "Persistently Weak But Monitor If The Price Can Reclaim The Prior Session Lows For A Bullish Reversal Trade".

Thursday 24-Aug-2023, 06h05 Gold. Short term target reached at $1921.

Wednesday 23-Aug-2023, 19h07 Update: AUD/USD buy/long trade idea approaching target. This evening, the pair trades at it's highest level (0.6474) since being recommended at 0.6399. This represents a 75 point gain. The full target is 0.7500. At current levels, traders can consider the following: If you're an active trader, big moves present the following options: (1) Bank/Take Profit (2) Raise your stop-loss (3) Scale out of the position as it approaches the target.

Wednesday 23-Aug-2023, 07h07 Update: USD/ZAR. The pair has started to unwind from short term overbought conditions. This is in line with last week Wednesday's comment at R19.08 which was as follows: "A pullback toward the mean (around R18.55 to R18.60) before a continuation of the upward trend cannot be ruled out." The chart below is 'current'.

Wednesday 23-Aug-2023, 06h40 Mr Price Group (MRP). According to the end of day tactical trading guide (automated price action data), the short term reading is as follows: "Reward-to-risk becoming attractive for a small buy/long position" while the medium term reading is as follows: "Aggressive selling. Wait for lower time frames to stabilize". Analyst Comment: The share has breached support but is approaching it's prior swing low. Traders should be open to the possibility of a piercing candle being printed or potentially a candle formation that suggests a bullish reversal e.g. 'doji' or long lower tail.

Wednesday 23-Aug-2023, 06h31 EXX - last week I pointed out how well TGA was acting relative to the Satrix RESI. The same can be said about it's sector peer EXX. You can see this by pulling up a simple relative chart (EXX/STXRES) but I also noticed some minor developments by reviewing EXX distance vs it's 200-day SMA. While the price has developed a lower low, the distance vs it's 200-day SMA has remained relatively flat.

The above EXX chart also ties in with my recent comment on the share where I highlighted the weekly chart. See the original slide below:

Wednesday 23-Aug-2023, 06h24 OMU - On Monday (pre-market) I highlighted both the buy and sell plan. On Monday the share traded into my provisional sell zone (right hand side) with the price seeing downside follow-through on Tuesday.

Monday 21-Aug-2023, 13h51 Gold ($1892). Has been trading in a clear and strong downward trend over the short term, with price continuing to make lower highs and lower lows. Here's what may be worth noting: The price has slipped below the prior swing low of 29 June, however, it is common the encounter a false breakdown following a strong downward trend. Also worth noting is the existence of a falling wedge technical formation, which can be considered bullish. On the macro front, the Jackson Hole Symposium takes centre stage this week which may have an impact on the credit, currency and commodity front.

Monday 21-Aug-2023, 10h53 Market Neutral/Pair Trade Idea. Update on Long FSR/Short NED (Monday, 08 May 2023 report). The pair is higher by 13.3% over the period vs the JSE Top 40's decline of 6.7%, resulting in a net return of 20% over the 14 weeks.

Sunday 20-Aug-2023, 11h32 Impala Platinum -Distance vs 200-Day SMA. Now trading 45% below it's 200-day SMA. Over the last decade (and even further back) this range of extension coincides with extreme oversold conditions. This is worth bearing in mind from a portfolio perspective.

Sunday 20-Aug-2023, 11h19 US 10-Year Bond Yield. Direction of Bonds = Massive Implications For Global Equities. Note the following: The yield is trading at 104% above it's 200-week SMA. This is one of the biggest extensions in over 40 years. Bottom Line? While the upper 4's are possible, we can see a pullback (downward move in yields). The extension vs the 200-week SMA may be unsustainable.

Lower bond yields = positive for equities.

Higher bond yields = negative for equities.

Friday 18-Aug-2023, 16h50 What a chart! A graphic that speaks to so much of the current environment.

New highs, lows for the Nasdaq, NYSE and AMEX.

Friday 18-Aug-2023, 15h58 JSE Top 40 https://www.unum.capital/post/jse-top-40-index-j200

Thursday 17-Aug-2023, 13h05 Observations on Richemont (CFR)

Currently at the '1st re-test' of it's 200-day SMA.

Trading outside of it's 2SD, 200-day linear regression channel (red/blue shaded area).

Approaching previous demand/supply zone.

As you already know, concerns around the Chinese economy have been a large driver share price weakness. This unwind might offer another opportunity to re-enter a buy/long for a rebound.

Arrow = potential price path.

Wednesday 16-Aug-2023, 19h10 Swing Screen. As of today's close, 9 names show up on the screen.

LHC (+3%) was one of the biggest gainers today. If you look at a ratio chart of the share vs the JSE Top 40, you'll notice it's at a multi-month high vs the market. I published a medium term buy/long idea on 31 July, taking a portfolio view.

Also from the screen, take a took at TBS and the potential downward trend line that can be breached. Following last year's strong run, the share has been in downward trend YTD, peaking at ~R229 to it's recent low of sub-R150. The big level to clear here, in my view, is 16200c.

Wednesday 16-Aug-2023, 18h18 Bidvest Group (BVT) - potential sell/short setup. Rising wedge technical formation (bearish).

Wednesday 16-Aug-2023, 16h34 Richards Bay Coal Futures - has started to turn up at a major long term level. Previous discussed here: https://www.unum.capital/post/richards-bay-coal-futures

Wednesday 16-Aug-2023, 11h05 Firstrand (FSR) - Trading at the lower boundary of a rising 2 standard deviation, 50-day linear regression channel. From a confluence perspective, this is in line with (1) the rising 50-day EMA (2) the prior swing lows and (3) the prior breakout level. The level between 6880c and 6920c is an ultra short term level of interest for traders looking to take advantage of a potential rebound.

Wednesday 16-Aug-2023, 09h02 USD/ZAR - the envisioned price path (yellow arrow) has developed out with the pair substantially weaker over the period due to: (1) higher US bond yields and (2) a stronger US Dollar. Note the following: the pair now trades at 2x standard deviation over 50 days, suggesting levels which coincide with 'short term overbought' conditions. A pullback toward the mean (around R18.55 to R18.60) before a continuation of the upward trend cannot be ruled out.

Tuesday 15-Aug-2023, 22h07 Shoprite Holdings (SHP) - trading at a fundamental valuation premium vs it's peer group. A 22x price/earnings ratio vs WHL (17x), PIK (13x) and SPP (10x). Don't get me wrong, this is a great business which has shown resilience and most likely deserves it's premium rating, however, how much is priced into the share? It's not far from it's all-time highs and has the ability to test it. Technically, it's struggling to hold above it's prior swing highs while also breaking to the downside of a rising wedge formation. At R200 it was extended well below it's 50/100-EMA and at R260 it was extended well above it's 50/100-EMA. Below are is view on a potential opportunity:

Tuesday 15-Aug-2023, 21h20 Anglo American Plc (AGL) - If you zoom out you'll know that R490 is a big level for the share (it closed at R491 yesterday). More broadly, you might recall me discussing R430 as another key level based on the weekly chart and more specifically the parallel channel. See the chart dated Friday 12 May below.

The correction in resource shares shouldn't come as a surprise. It's a sector discussed from late last year (November) as well as early this year. For example AGL at R752 on 19 January. Thus far, a 34% share price decline.

Tuesday 15-Aug-2023, 21h05 Thungela Resources (TGA) - relative to it's broader resources peer group, the share has shifted above it's 50-day EMA on the ration chart. Here I am using TGA vs STXRES (Satrix Resi). This is an early positive development on a relative basis.

Thungela Resources has been a serial underperformer since losing it's relative trend line in October 2022. At the time the potential underperformance was highlighted, which would have signaled an UNDERWEIGHT position in the share vs the broader market. The original chart is is show below (29 October 2022). Since then, the share is down by 57% from 28909c to it's recent low of 12350c.

AT&T (T) - False breakdown, then potential rally? I'm watching this for a potential buy/long.

Tuesday 15-Aug-2023, 08h20

Sanlam (SLM) - Update: Short Term, A Double Top? As discussed here last week: https://www.unum.capital/post/sanlam-ltd-slm-thursday-10-august-2023

Tuesday 15-Aug-2023, 08h08

JSE Banks - Update: Potential distribution underway. The equally-weighted, relative to the market was discussed here: https://www.unum.capital/post/jse-banks-vs-jse-top-40-a-logical-level-for-a-pause-wednesday-02-august-2023

Tuesday 15-Aug-2023, 08h14

Standard Bank (SBK) - Distance vs 200-Week Simple Moving Average

Friday 11-Aug-2023, 16h35

Satrix Resources (STXRES) Relative To Satrix Financials (STXFIN)

Thursday 10-Aug-2023, 17h02

JSE Chemicals Sector (Equally-Weighted) Relative To JSE Top 40 Index

Thursday 10-Aug-2023, 15h04

Comments